Introduction

Ozempic’s Influence on Novo Nordisk Stock Market Position

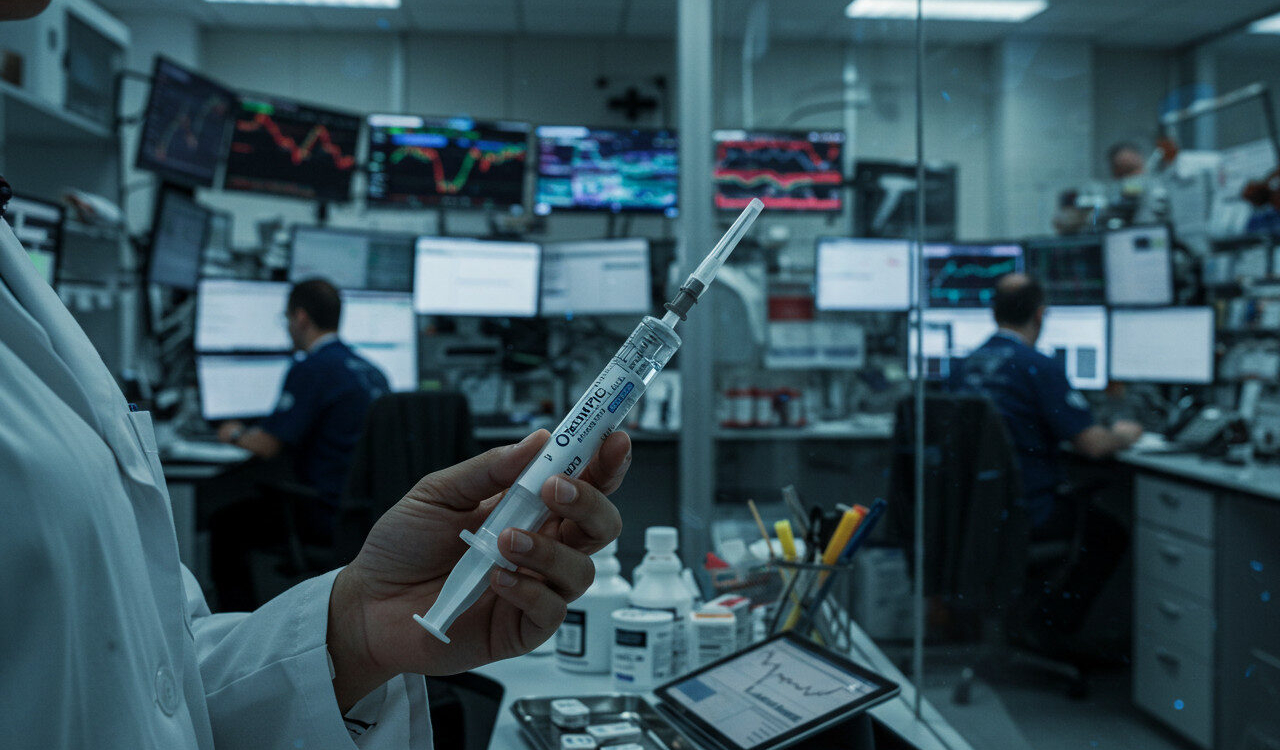

Ozempic has reshaped diabetes care while influencing Novo Nordisk’s market capitalization. Investor sentiment responds directly to prescription growth, clinical trial news, and competitive developments. The company balances innovative healthcare solutions with strategic financial decisions, helping maintain a strong position despite market fluctuations.

What Is Ozempic

Ozempic is a once-weekly injectable treatment for type 2 diabetes that mimics the GLP-1 hormone. It improves blood sugar regulation and supports weight loss, creating dual benefits for patients. This effectiveness has driven widespread adoption by healthcare providers and patients alike, positioning Ozempic as a key driver of Novo Nordisk’s stock performance.

Novo Nordisk Market Role and Company Snapshot

Founded in 1923 and headquartered in Denmark, Novo Nordisk is a global leader in diabetes and obesity care. The company is known for patient-centered innovation and a robust research pipeline. Strong earnings, consistent revenue growth, and strategic market positioning have made it a resilient presence in the healthcare sector.

Recent Performance and Market Developments

Recent Earnings and Share Value Impact

Novo Nordisk’s revenue growth has been driven largely by Ozempic’s market demand. Positive earnings reports have influenced bullish stock trends, with technical indicators like moving averages reflecting investor confidence.

News Events That Shift Investor Outlook

Announcements of clinical trial successes, regulatory approvals, or partnerships can create sharp stock movements. Competition from companies like Eli Lilly, along with emerging treatments, affects daily trading patterns and overall investor sentiment.

Main Factors Shaping Novo Nordisk Stock Outlook

- Ozempic demand: Continuous growth strengthens revenue and stock performance

- Competitor activity: Rival drugs and market entries, especially from Eli Lilly, influence market share

- Earnings per share trends: Positive EPS growth signals financial stability

- Technical indicators: Moving averages and momentum indicators guide investor expectations

- Innovation pipeline: New treatments for obesity and rare diseases affect long-term growth

Market Trends, Competition, and Growth Signals

Rapid adoption of Ozempic for weight loss and diabetes management signals strong growth potential. Monitoring prescription trends, clinical trials, and public health adoption is critical for forecasting stock performance. Technical indicators suggest possible long-term growth, although competition continues to rise.

Risks That May Affect Stock Value

- Patent expirations: Generic competition could reduce revenue

- Regulatory changes: New laws could limit market access

- Litigation: Legal challenges may impact reputation and finances

- Competitive pressure: Fast-moving competitors like Eli Lilly may gain market share

How to Analyze and Forecast Novo Nordisk Stock

Investors should evaluate historical stock movements, earnings, and revenue growth alongside external factors such as approvals, regulations, and competitor actions. Trusted tools like Yahoo Finance, Bloomberg, TradingView, MetaStock, TipRanks, and Zacks provide data for technical and fundamental analysis. Combining moving averages, EPS trends, and sentiment analysis supports informed forecasting.

Ozempic Stock Forecasts for 2025 to 2030

| Year | Projected Price | Key Factors |

|---|---|---|

| 2025 | $130–$160 | Strong Ozempic demand, positive investor sentiment, market positioning |

| 2026 | $145–$175 | Continued growth with monitoring of patent expirations and competitor activity |

| 2030 | $151–$270 | Leadership in chronic disease treatment, innovation, and diversified product portfolio |

Final Thoughts

Novo Nordisk’s future stock performance depends on sustaining Ozempic demand and managing competitive pressures. Strong financial health, ongoing innovation, and public adoption of treatments provide a solid foundation. Investors should monitor market indicators, patent timelines, and competitor activity to make informed decisions in this evolving healthcare sector.

Frequently Asked Questions

How does Ozempic sales growth affect Novo Nordisk stock price?

Increased Ozempic sales typically boost revenue, signaling strong product demand. Higher demand can lead to bullish investor sentiment and upward stock movements. Analysts monitor sales trends to adjust forecasts accordingly.

Are there risks or competitors that could change stock performance?

Yes, patent expirations, regulatory changes, and competitor activity—particularly from Eli Lilly—can significantly influence stock performance. Monitoring these factors is critical for investment decisions.

What happens when Ozempic’s patent is close to ending?

Once the patent expires, generic competition may reduce revenue. Novo Nordisk will need to innovate or diversify its product portfolio to maintain growth and market share.

Is Novo Nordisk stock suitable for new investors?

Novo Nordisk stock has long-term potential but can experience volatility. New investors should assess risk tolerance, follow earnings reports, and track competitor developments before investing.

How do earnings reports impact stock value?

Positive earnings reports reflecting strong revenue growth often lead to increased stock prices. Investor confidence and analyst recommendations typically respond to these metrics.

What technical indicators are useful for analyzing the stock?

Moving averages, relative strength index, and momentum indicators help investors evaluate trends and potential price movements. Combining these with fundamental analysis strengthens decision-making.

How does competition from Eli Lilly affect Novo Nordisk?

Eli Lilly’s competing drugs can reduce Novo Nordisk’s market share and influence stock volatility. Tracking competitor drug approvals and market adoption is essential for forecasting performance.

Updated by Albert Fang

Source Citation References:

+ Inspo

24/7 Wall St. (2025, July 21). Novo Nordisk (NYSE: NVO) Stock Price Prediction and Forecast 2025–2030. 24/7 Wall St.