Insurance Declarations Page Explained

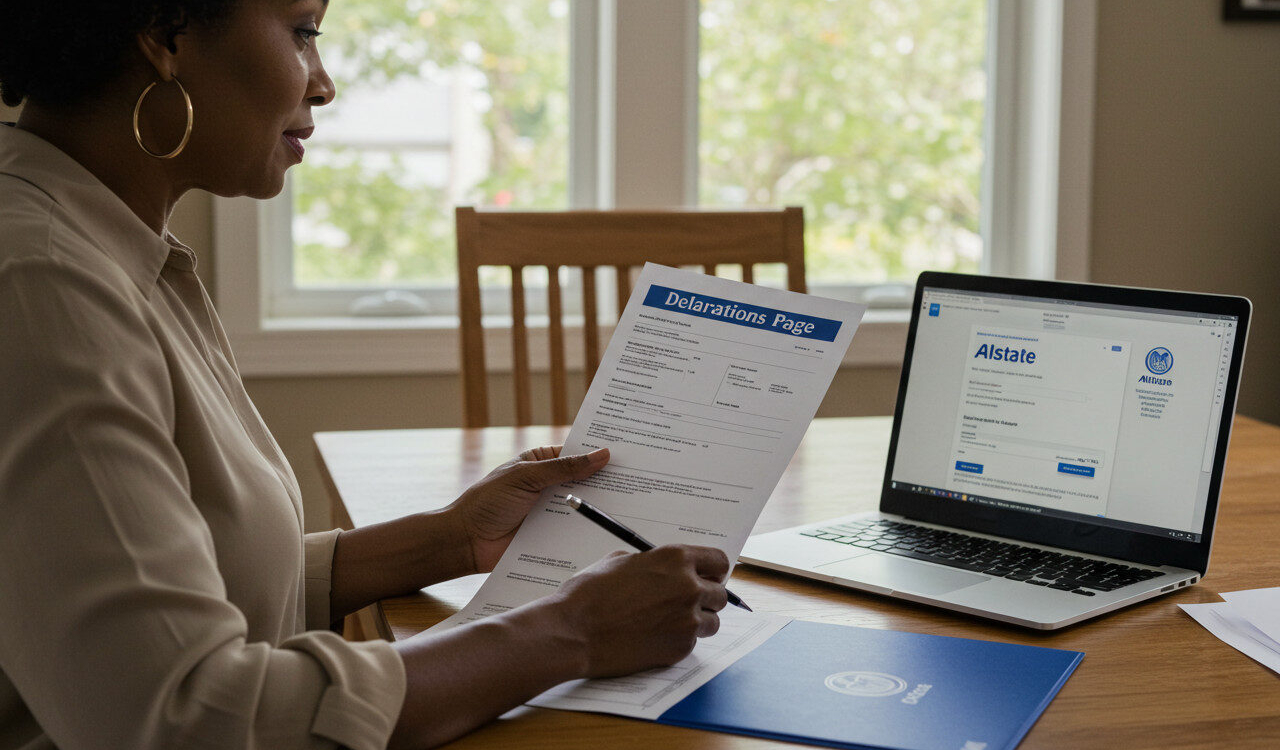

Understanding your insurance declarations page helps you manage your policy well. Your insurance company gives you this document when you buy or renew a policy. The page shows your coverage details in a simple way. It lists the types of coverage you have, the limits for each, and the amount you will need to pay if you make a claim. The same goes for auto, homeowners, or renters insurance. This page makes it easy to see the important parts of your policy. When you read it closely, you can check that all the details are right and know what you are covered for. This helps you make good choices about your insurance.

The following sections explain the main parts of an insurance declarations page and why understanding them matters.

What an Insurance Declarations Page Includes

Your declarations page is a very important part of your insurance policy. It is a clear and simple page that shows you the key details of your insurance. This page includes things like your coverage, your limits, and information about who is insured. If you have questions about your policy or if something happens and you need help, this page will guide you.

Usually, the first part of policy papers is the declarations page. The setup of this page makes it easy to spot the main parts of your policy. This helps people who have the policy get the information they need fast and in a clear way.

What Information Is Shown on the Declarations Page

The insurance declarations page is full of important details that help you read and understand your coverage. Below are the main pieces of information it has:

Policy Limits and Amounts of Coverage

The policy shows the rules. It tells you the most money the company will pay you. You can find the coverage limits for things like injury or damage. This part helps you know what you can get for each kind of loss.

Deductibles and Endorsements

- Deductibles: This is the money you have to pay yourself before your insurance will start to pay for other costs. Look at the amount for each type of coverage.

- Endorsements: These are extra coverages added to your policy for certain needs, like hurricane coverage or animal claims.

Mortgagee or Lender Details

If you have used a loan to buy your property, your insurance declarations page will list the bank or company you borrowed from. You will see the name of the lender and how to contact them. This can be useful when you want to file a claim or change your policy.

| Category | Details |

|---|---|

| Coverage Details | Types of insurance and their respective limits |

| Deductibles | Out-of-pocket amounts for different claims |

| Policy Endorsements | Riders for special conditions or added coverage boosts |

| Mortgagee/Lender Info | Financial institution’s name and contact information |

Types of Insurance Declarations Pages

There are different insurance declaration pages for auto, home, and renters insurance. Each one has its own use and tells you something new. Here is what you can get in each type of these:

Auto Insurance Declarations Page

This page shows the details of what is covered, the limits of your policy, and the amount you need to pay out of your own pocket before your plan starts to pay. It makes sure that you know what you get if there is a loss.

Homeowners Insurance Declarations Page

This gives you the key facts about what parts of your home are covered, any add-ons, and the name of your mortgage company. It shows how your home and things are kept safe from loss.

Renter’s Insurance Declarations Page

This page is your proof that you have insurance. It points out which of your things are covered and shows how much you get for problems that may come up. This helps renters feel sure that their stuff is covered.

Reading and Using Your Insurance Declarations Page

Trying to read your insurance declarations page can feel hard at first. But it is not as tough as you might think. This paper is made to give you a short and clear look at your insurance. It will help answer all of the important questions you have about your policy.

Start by getting to know the policyholder name, coverage types, deductible amounts, and policy limits. Check that these details are right and match what you need. If there is something that does not look right or if you do not understand it, get in touch with your insurance company.

What to Have Before You Review

- Policy Documents: Have all your insurance papers with you. You can get this online or ask for paper copies.

- Insurance Company Contact: Keep your insurer’s number or the number for customer help. Use it if you want to ask about anything.

- Identification: Check that the names on your plan are right.

Also, be sure you have your policy number, updates from past reviews, and information about your current coverage needs. This will help you feel sure when you look at coverage amounts, deductible choices, and extra options.

How to Access and Review Your Declarations Page

Step 1: Locate Your Policy Documents

To find your whole policy, you need to know how your insurance company sends you documents. You could get these on paper, by email, or from an online portal. Start by looking for the title page of your policy. The insurance declarations page usually comes first to make things clear.

Step 2: Identify Key Sections and Coverage Details

The coverage details part of your insurance declarations page gives you lots of important information. It shows the types of coverage, the policy limits, and the amount you have to pay for deductibles. Make sure this information is right and check that your coverage matches what you need.

Step 3: Prepare for Event of Loss

Look at the deductible amounts and read any fine print about claims. It is good to know these things. They help you get ready if you need to make a claim and know what you will have to pay.

Final Thoughts on Insurance Declarations Pages

Knowing how to read your insurance declarations page is very important when you manage your policy. This paper gives you a clear look at what your insurance covers and the main details about your plan. When you take the time to go through what is on the declarations page, you can feel sure that you have the coverage you need and do not get caught off guard with claims. Looking over this page from time to time helps you stay aware and lets you make changes when your life changes.

If you need more help to go through your insurance papers or if you have some questions, feel free to ask for a free meeting. Your peace of mind is just one talk away!

Frequently Asked Questions

Is an insurance declarations page the same as proof of insurance?

An insurance declarations page is not the same as proof of insurance. The declarations page shares the main details of your policy, but proof of insurance is usually a card or certificate. Both of these papers are given to you by your insurance company. You can use them for your records or when people need to see that you have insurance.

How can I request a copy of my declarations page?

To get your declarations page, reach out to your insurance company. You can call customer support or talk with your agent. If you are the person who owns the policy, they will use your details to confirm who you are. This helps you get your “dec page” fast.

Why is it important to review your declarations page each year?

Looking over your declarations page every year helps you keep your policy limits and coverage in line with any updates. These updates may include new changes, like added endorsements or changes to any risks. When you stay informed, you make sure that you and your things stay protected.

What should I do if information on the declarations page is incorrect?

If you see a mistake on your declarations page, act fast. This is important because it can affect your coverage if something happens. Get in touch with your insurance company right away and tell them about the mistake. When you talk to them, make sure all changes match what is true for you. This will help keep your coverage right and up-to-date.

Updated by Albert Fang

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.